LRP VS. FUTURES

WHICH RISK MANAGEMENT TOOL IS BETTER?

In the last couple of months, several of us at FVC and PCM have gotten questions from producers on which risk management tool, LRP vs. Futures, is better for a pork producer?

Like most tools, the answer depends on your operation’s goals and situation. For this edition of the Dr.’s Corner, we will examine the situations that tend to favor the LRP tool.

As a quick review, LRP (Livestock Risk Protection Plan) is an insurance plan subsidized by the Risk Management Agency (RMA) of the USDA. LRP is designed to help insure pork producers against declining market prices.

LRP differs from the Futures Market in these areas:

- LRP does not require margin culls and so a producer does not need a hedge account.

- The premium for the Specific Coverage Endorsement (SCE) of an LRP is not due until up to 30 days after the close of the SCE.

- The cost of the insurance is subsidized by the Federal government (RMA).

- The LRP has more flexibility in the number of head that can be covered than a future’s contract.

For some producers, the above differences may make the LRP option more advantageous than the Future’s Market.

To look at past performance of both the LRP program calculations and the future’s market, Mike Wubbena, CEO/COO of PCM created a spreadsheet to analyze any differences in the two tools.

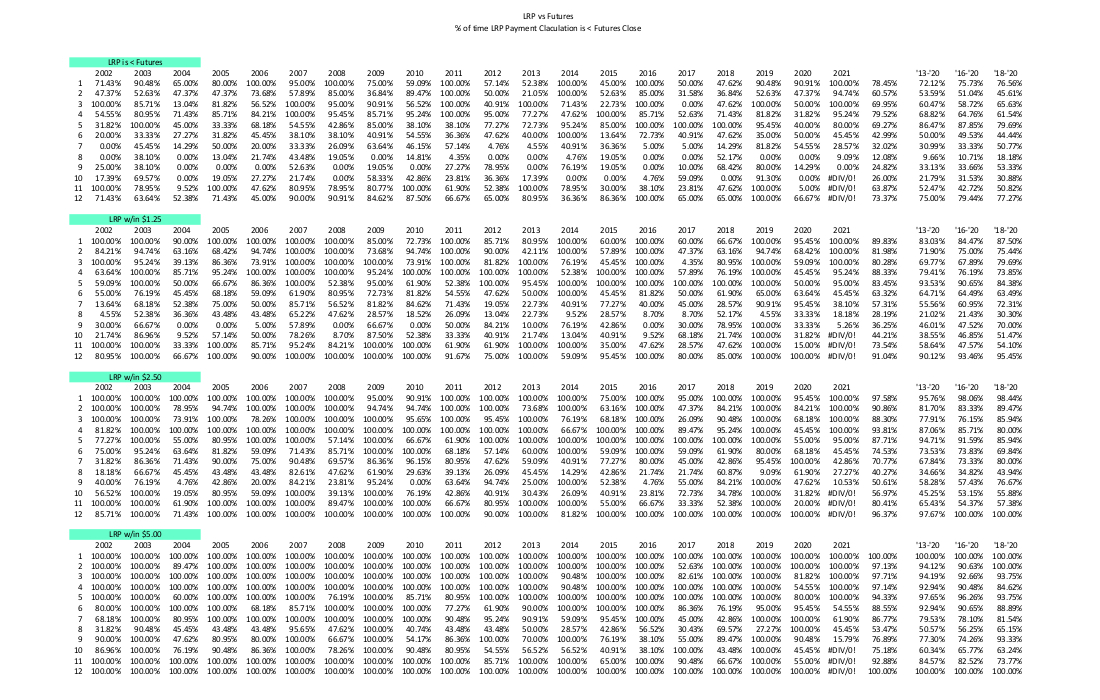

Table 1 depicts the results of Mike’s analysis of LRP versus Futures Market.

In Mike’s analysis, he compared the LRP calculation versus the future’s market close for each day of the past 20 years! The percentage expressed for each month of the given year in the first section of the table is the percentage of days in that month in which the LRP calculation is lower than the futures close or in other words, the LRP would potentially indemnify more than the futures market.

As an example, if a producer bought a put option at $95 that expired on October 15 and bought a LRP SCE for $95 at 100% coverage to end October 15 and the futures closed at $90 and the LRP SCE calculation came in at $87 (i.e., LRP SCE calculation lower than futures close), the producer would get paid $8.00 for the LRP and make $5.00 for the futures put.

As a reminder, the LRP calculation looks at the actual market price published that day of the SCE close from the Agricultural Marketing Service of the USDA to determine if an indemnity is due. If calculated actual price is less than the SCE offer, an indemnity is paid.

As an example, in January 2021, all the days of that month had LRP potentially paying more than the futures market. Conversely, in September 2021, all the days of that month had the futures market potentially paying more than LRP (zero days had LRP lower than futures close).

The tendency that shows itself from Mike’s analysis is that a SCE of a LRP has a higher probability of paying more versus futures in the months of December to May while the futures market has a higher probability of paying more in the months of June to November.

For the months of June to November, the LRP tool is not completely off the table. It may be months where a producer looks at using a lower percentage of coverage to keep costs in line with a minimal catastrophic coverage plan. (i.e., think about ASF introduced into the U.S.!)

The other sections of Mike’s spreadsheet looks at the percentage of days in each month that the LRP is within the given range of the futures market ($1.25, $2.50 or $5.00). As an example, in 2019, LRP was better or within a $1.25 of the futures market over 90% of the days in all the months except June and August.

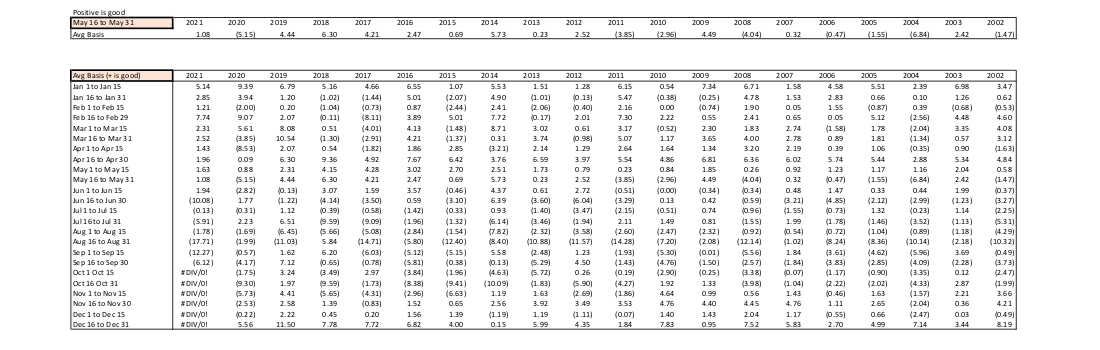

Table 2 depicts the average basis of the SCE LRP calculations versus the future’s close for the given time frames per year. In this Table 2 a positive basis is good for the SCE of an LRP. Again, this data supports more probability of an SCE of a LRP being better than futures in December through May for most years.

As a common caution with all analysis, past performance is NO guarantee of future performance!

Also, it is imperative that producers have accounting protocols in place so they know their cost of production and can better determine when to use risk management tools.

If you have any further questions, please contact Mike Wubbena, Justin Borchardt, or Dr. Brian Roggow